|

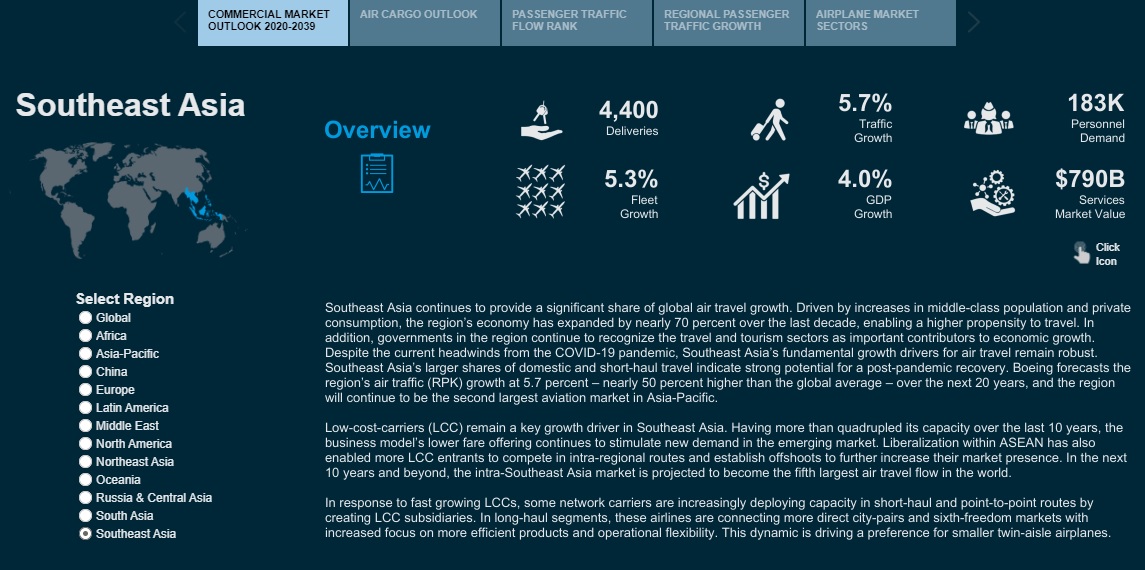

Boeing anticipates airlines in Southeast Asia will

need 4,400 new airplanes valued at US$700 billion to support

expanding demand for air travel over the next 20 years.

The intra-Southeast Asian market will become the

fifth largest in the world by 2039, and the vast domestic and

regional air-travel network across the region positions it well

for a post-pandemic recovery, according to Boeing�s 2020

Commercial Market Outlook (CMO).

With low-cost carriers providing affordable

service and added capacity, the CMO projects passenger traffic

growth in Southeast Asia to grow by 5.7% annually throughout the

forecast period. Through the period, Southeast Asia will become

the second largest aviation market in the Asia-Pacific region

after China.

Boeing projects the region�s commercial airplane

fleet will grow 5.3% annually over the next 20 years. In addition,

demand for aftermarket commercial services � valued at US$790

billion � will help maintain the fleet over the same period.

�Southeast Asia�s fundamental growth drivers

remain robust. With an expanding middle-class and growth in

private consumption, the region�s economy has grown by nearly 70%

over the last decade, which increases propensity to travel,� said

Darren Hulst, Boeing vice president of Commercial Marketing. �In

addition, governments in the region continue to recognize the

travel and tourism sectors as important drivers of economic

growth.�

While near-term airplane deliveries are impacted

as a result of the pandemic�s effects, Boeing estimates operators

will need more than 3,500 new single-aisle airplanes in the region

by 2039.

Single-aisle airplanes like the 737 family will

continue to drive capacity growth in Southeast Asia, where

low-cost-carriers have the highest market penetration globally.

Twin-aisle airplanes such as the 777X and 787

Dreamliner will remain foundational to Southeast Asia�s air travel

industry. Over the next 20 years, nearly one in four twin-aisle

airplanes delivered to the broader Asia-Pacific region will go to

a carrier operating in Southeast Asia.

Overall, Boeing forecasts regional demand for 760

new widebodies by 2039, enabling efficient replacement and

versatile network growth for Southeast Asia�s airlines. While

long-haul market recovery is expected to take longer, Southeast

Asia�s twin-aisle fleet is slated to grow by 55% � to 780

widebodies � by 2039.

The region�s commercial aviation services growth

remains promising in the long term. Southeast Asia commercial

services are valued at US$790 billion over the next 20 years, a

slight increase from last year�s projection, driven largely by

growth in freighter conversions and digital solutions and

analytics.

The region is expected to require 183,000 more

commercial pilots, cabin crew members and aviation technicians

over the forecast period.

Globally, Boeing projects the need for 43,110 new

commercial airplanes and the demand for aftermarket services to be

equivalent to US$9 trillion over the next two decades. World air

cargo traffic is projected to grow 4% annually due to solid

industrial production and world trade.

Freighters will remain the backbone of the cargo

industry with the need for 930 new and 1500 converted freighters

during the same span.

The complete forecast is available in .pdf

here.

See latest

Travel Industry News,

Video

Interviews,

Podcasts

and other

news regarding:

COVID19,

Boeing,

Forecast,

Outlook.

|

Headlines: |

|

|