|

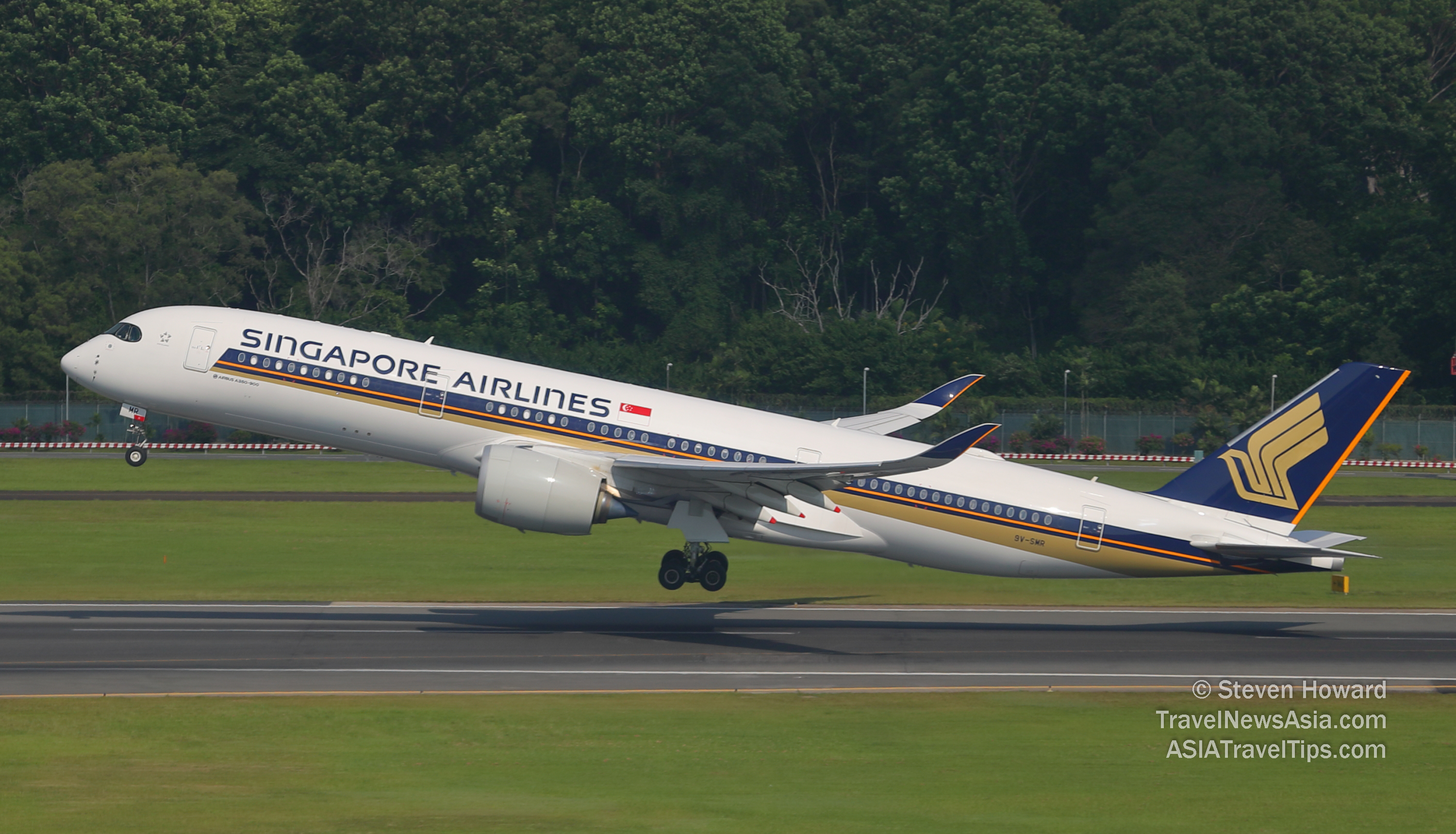

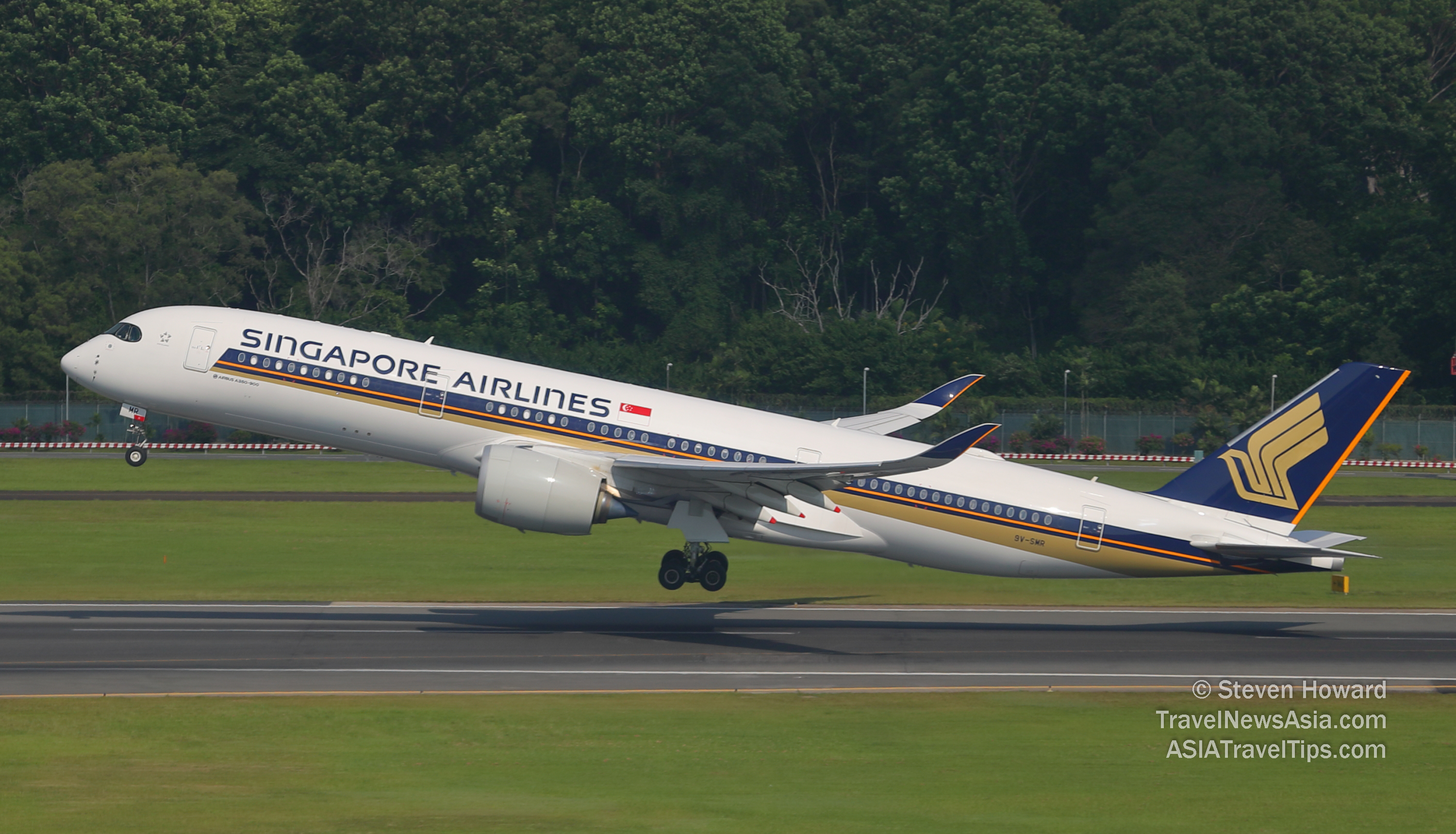

Singapore Airlines has confirmed that it raised

S$10 billion of liquidity through its recent Rights Issue, as well

as a mix of secured and unsecured credit facilities.

SIA secured S$8.8 billion in liquidity through the

successful completion of the rights issue on 5 June 2020. A

further S$900 million was raised through long term loans secured

on some of SIA�s Airbus A350-900 and Boeing 787-10 aircraft.

The company has also arranged new

committed lines of credit and a short term unsecured loan with

several banks, which provide further fresh liquidity amounting to

more than S$500 million.

Separately, all existing committed lines of credit

that were due to mature during the course of 2020 have been

renewed until 2021 or later, thus ensuring continued access to

more than S$1.7 billion in liquidity.

During this period of high uncertainty, SIA has

said that it will

continue to explore additional means to shore up liquidity as

necessary.

For the period up to July 2021, the company also

retains the option to raise up to a further S$6.2 billion in

additional mandatory convertible bonds, which will provide

additional liquidity if necessary.

Goh Choon Phong, Singapore Airlines Chief Executive,

said, �We are grateful for the strong support of our shareholders

for our successful rights issue, which has secured the company�s

future amid an unprecedented global health and economic crisis. We

are also grateful to our relationship banks for their support in

extending additional secured and unsecured loans, as well as

committed lines of credit. SIA will remain steadfast and agile

during this period of great uncertainty, and continue to act

nimbly in responding to the evolving market conditions.�

See latest

Travel News,

Video

Interviews,

Podcasts

and other

news regarding:

COVID19,

Singapore Airlines,

Singapore.

|

Headlines: |

|

|