|

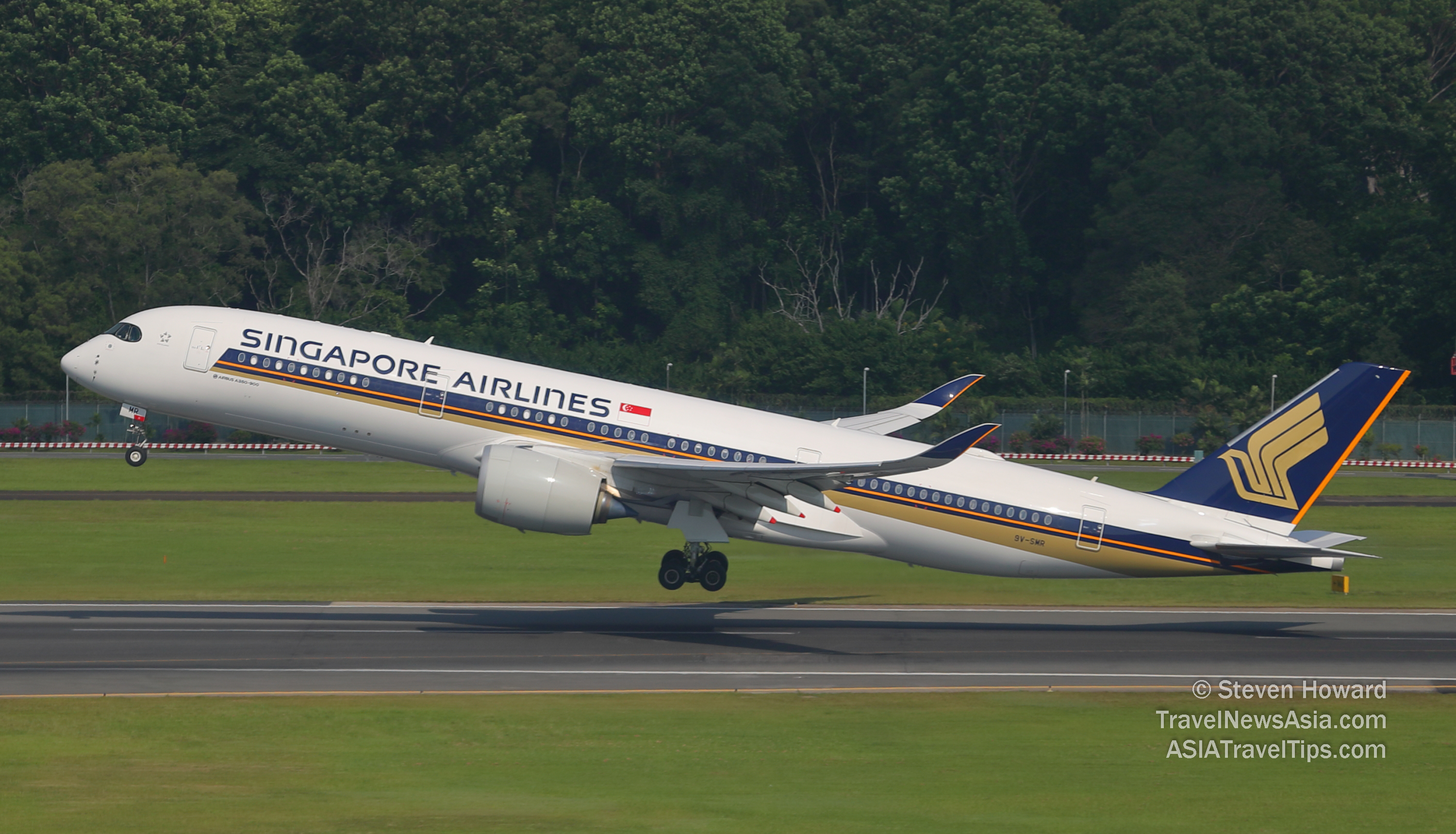

Singapore Airlines is to offer all shareholders

S$5.3 billion in new equity and up to a further S$9.7 billion

through 10-year Mandatory Convertible Bonds (MCB), with S$3.5

billion of that raised through MCB and the remaining S$6.2 billion

raised over subsequent months.

Both will be offered on a pro-rata basis via a

rights issue, and both issuances will be treated as equity in the

company�s balance sheet.

SIA has also arranged a S$4 billion bridge loan

facility with DBS Bank to support the company�s near-term

liquidity requirements.

Singapore Airlines intends to use the proceeds from the

rights issues to fund capital and operational expenditure

requirements.

SIA Chairman Peter Seah said, �This is an

exceptional time for the SIA Group. Since the onset of the

COVID19 outbreak, passenger demand has fallen precipitously amid

an unprecedented closure of borders worldwide. We moved quickly to

cut capacity and implement cost-cutting measures. The strong commitment and support from our staff

and our unions as we work together on measures to tackle this

crisis have been remarkable. I am heartened that our people are

doing everything they can, in these most difficult of times, to

support our customers and sustain our operations. We have also

worked closely with the Singapore government to bring Singaporeans

home safely during this time. At the same time, we are also

working with various parties to enable our staff on no-pay leave

to have other income opportunities. We are especially grateful for Temasek�s strong

vote of confidence. The Board is confident that this package of

new funding will ensure that SIA is equipped with the resources to

overcome the current challenges, and be in a position of strength

to grow and reinforce our leadership in the aviation sector.�

Both rights issuances are subject to shareholder

approval at an extraordinary general meeting (EGM) that will be

held in due course.

SIA�s largest shareholder Temasek Holdings will

vote in favour of the resolutions and procure a subscription for

its full entitlement and the remaining balance of both issuances.

Temasek International CEO, Dilhan Pillay

Sandrasegara, said, �The impact of COVID19 on the global travel

industry is unprecedented, especially for airlines and the related

sector players. SIA has been seeing strong growth before the hit

from the pandemic. It has also committed to fleet renewal as part

of its transformation journey. This transaction will not only tide

SIA over a short term financial liquidity challenge, but will

position it for growth beyond the pandemic. We fully support

SIA�s plans to transform itself. This includes the modernisation

of its fleet. The delivery of a new generation aircraft over the

next few years will provide better fuel efficiencies as well as

meet its capacity expansion strategy.�

The aviation sector is a key pillar of Singapore�s

economy and creates more than 12% of the country�s GDP and

supports 375,000

jobs. SIA, SilkAir and Scoot account for more than half of the

passengers flying in and out of Changi Airport.

See latest

Travel News,

Interviews,

Podcasts

and other

news regarding:

Singapore Airlines,

Changi,

Singapore.

|

Headlines: |

|

|