|

ATR published its new Market Forecast

(2018-2037) on Monday, in which it estimates a market for 3,020 turboprop

aircraft in the next 20 years.

In the 2018-2037 market forecast, nearly

80% (2,390 aircraft) of the total demand is expected to come from

the 61-80 seat category, a market segment served for years by the

ATR 72.

The remaining 20% (630 aircraft) will come from the 40-60

seat market, a segment where the ATR 42, the only 50-seat aircraft

available new on the market, provides strong potential for the up

gauge of 30-seat, and the replacement of 50-seat, regional

aircraft.

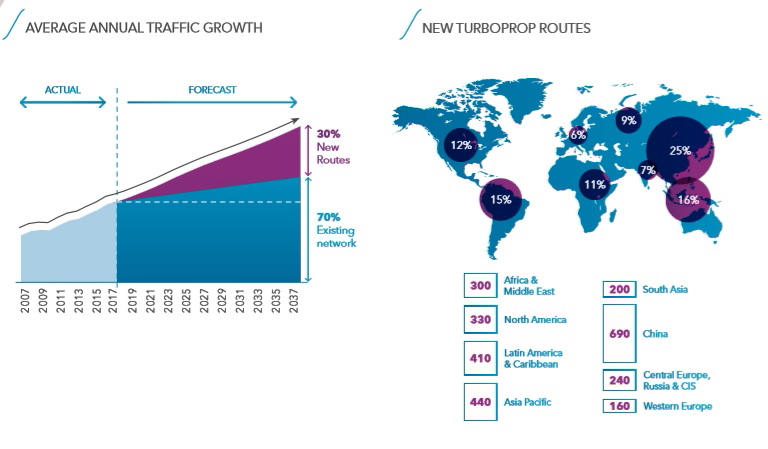

Over the next 20 years, the largest

demand for turboprops is expected to come from Asia (43%),

followed by Europe, Africa and Middle East (31%) and the Americas

(26%).

Beyond passenger aircraft, ATR estimates

that the increase of freight traffic will generate, over the next

two decades, a potential for the delivery of 460 turboprop

freighters. This includes converted aircraft as well as the

recently launched ATR 72-600F, the only regional cargo aircraft

available straight from factory.

There are several

drivers that can explain the expected high demand for turboprops

Regional aviation

has experienced an outstanding development, with 58% of the

current regional networks worldwide having been created over the

last 15 years. The growth of the regional routes has been

particularly intense in the period 2012 � 2017, with ATR playing a

major role, with an annual average of over 100 new routes created,

and a record of 155 new routes in 2017.

Today, turboprops operate

half of the flights below 330 nm all over the world. Based on their current and recent success in

opening new routes with the lowest risk, ATR estimates that

turboprop aircraft have the potential to generate 2,770 new routes

in the 20 years to come. During this period, regional traffic is

expected to grow annually at a pace of 4.5%, with around 30% of

the traffic in 2037 coming from routes that do not currently

exist.

Air connectivity plays an essential role in boosting local

economies. An increase in flights of 10% generates additional

increases of 5% in tourism, 6% in regional GDP and 8% foreign

direct investment. Turboprops are key in connecting communities around

the world: 36% of all commercial airports rely exclusively on

turboprops and 50% rely, also exclusively, on regional aircraft.

Besides the recent launch of the

new ATR 72-600F freighter version, ATR is evaluating a version of the

ATR 42-600 with enhanced performance at take-off and landing, thus

potentially expanding accessibility and opening new routes and

markets.

The turboprop manufacturer will also expand operational

versatility with the new ClearVision system, a first in commercial

aviation, currently under certification, that enhances pilot

visibility and awareness.

The expansion of customer support and

services, along with their progressive digitalisation, will also

continue to play a key role in the success of turboprops in the

years to come. Today, with an in-service fleet of over 1,100

aircraft, ATR�s services revenue represents some 20% of the total

turnover, and is expected to grow by 10% annually.

See latest

HD Video

Interviews,

Podcasts

and other

news regarding:

ATR,

Outlook,

Forecast.

|