|

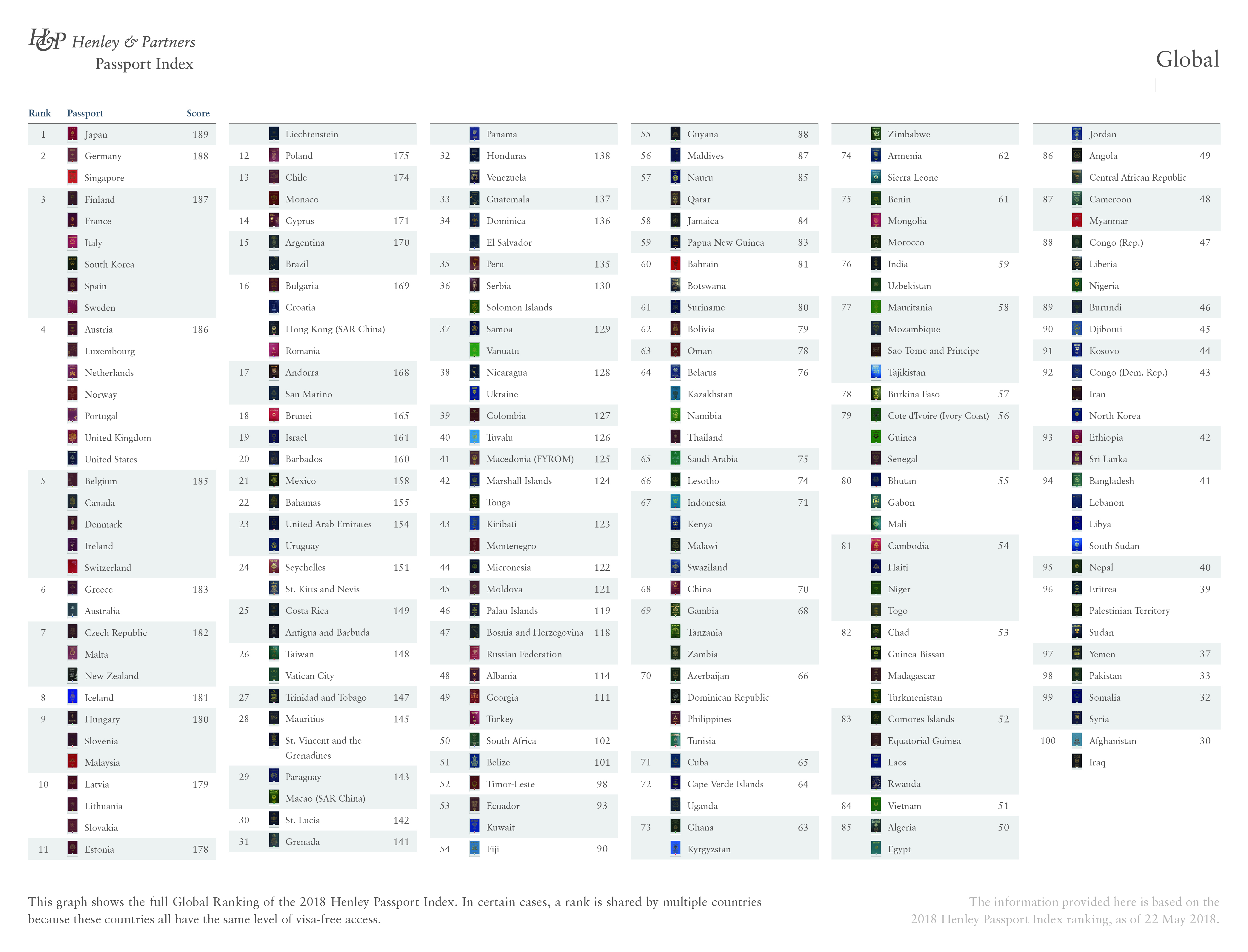

Singapore has moved down one spot to 2nd place,

alongside Germany, with visa-free access or visa-on-arrival to 188

countries, as Japan consolidates its spot at the top of the Henley

Passport Index, now offering its citizens access to a record total

of 189 destinations, including Benin as of March.

Third place is

shared by six countries: one Asian (South Korea) and the rest

European (Finland, France, Italy, Spain, and Sweden).

While Schengen Area countries have traditionally

topped the index as a result of their open access to Europe,

developed Asian nations have been able to secure equally high

scores in recent years thanks to their strong international trade

and diplomatic relations. With close to 40 visa-waiver agreements

signed by governments since the start of the year,

passport-holders around the world go into the summer season with

greater collective access than ever before.

Boosting this trend, Russia � which is usually

off-limits to nationals of most countries � announced in April

that visas would be waived for all travelers holding tickets to

the June�July FIFA World Cup. Nonetheless, the country has fallen

from 45th to 47th position on the Henley Passport Index compared

to Q1, thus far unable to catch up to regional leaders Ukraine and

Moldova, both of which have signed a number of visa agreements

since the start of the year.

The UAE, in 23rd place, remains the fastest

overall climber on the index, ascending 38 places since 2008. The

country has secured more new visa-waivers for its citizens in 2018

than any other jurisdiction in the world and is quickly closing in

on the lead that Israel, in 19th place, has historically held

within the Middle East region.

The US and the UK are tied in 4th

place, along with Luxembourg, the Netherlands, and Portugal; the

US has climbed one place compared to Q1 while the UK has remained

stable.

Having gained access to the UAE, Oman, and

Bosnia and Herzegovina this year, China has significantly

strengthened its position on the ranking, climbing from 74th to

68th position since Q1 � although the country�s relatively low

score of 70 visa-free or visa-on-arrival destinations means that

it still cannot compete with North Asian high-performers Japan and

South Korea.

The Henley Passport Index is based on

exclusive data from IATA, has recently been updated through extensive research to

include eight new travel destinations. Dominic Volek, Managing

Partner of Henley & Partners Singapore and Head of Southeast Asia,

says that the continuous updates made to the index make it the

most informative and dynamic index of its kind.

�The index now

encompasses almost all of the world�s destinations for which

travel information is publicly available. The Henley Passport

Index surveys a total of 199 different passports against 227

different travel destinations, including countries, territories,

and micro-states. The index is innovating the way we map and

measure travel freedom, making it easier for individuals to

understand where exactly they lie on the spectrum of global

mobility,� Volek said. �In order to ensure our index is the

most robust, we�re continuously improving our methodology. With

that said, although Singapore moved down slightly in ranking due

to its loss of visa-free access to Kosovo, with the addition of

new destinations to our database, such as Greenland, Faroe

Islands, Monaco, Andorra, Liechtenstein, Palestinian Territories,

Vatican City, and Monaco, we�ve seen Singapore�s score move up

from 180 to 188 since Q1.�

UAE Races Ahead

Leading global efforts towards improved travel

freedom is the UAE, which has gained access to eight new countries

in 2018 alone: China, Ireland, Burkina Faso, Uruguay, Guinea,

Tonga, and Honduras. The country�s reciprocal agreement with China

in particular has led to the Emirati hospitality and tourism

industries reporting growth of up to 70% compared to 2017, as

Chinese travelers begin taking advantage of their newfound access

to the Middle East�s main hub. The Emirati Ministry of Foreign

Affairs said recently that the country is actively strengthening

its diplomatic efforts in a bid to have one of the top five

passports in the world, as per the UAE�s Vision 2021.

Ryan Cummings, Director at Signal Risk and a

leading commentator on the MENA region, said,

�The visa-waiver agreements signed by the UAE to date are very

much in line with the country�s ongoing intention to position

itself as the foremost commercial hub in the Gulf Cooperation

Council (GCC) zone, where it is increasingly hosting the regional

headquarters of multinational firms operating in culturally

diverse industries such as healthcare, professional and financial

services, and digital technologies. These developments also

reflect the country�s publicized goal of shifting its economic

dependence away from the extractive industry towards tourism,

where it aims to create an ambitious 720,000 employment

opportunities within the sector by 2028.�

Economic diversification away from the oil

sector and towards the less volatile tourism industry has in fact

become a common theme across the GCC zone.

�Qatar extended a visa-waiver program to more than 80 countries in

the final quarter of 2017, and the country has continued this

trend in 2018, as part of its aim to attract 8 million tourists

annually by 2030. Saudi Arabia, too, issued inaugural tourist

visas on 1 April this year, seeking to secure its own target of 30

million tourists by 2030. Bucking the trend in the GCC, however,

is Oman, which withdrew the universal issuance of visas-on-arrival

in March 2018. Visitors from all except a few select countries

will now have to apply for an e-Visa via the Royal Oman Police

website before traveling to the area,� said Cummings.

China Starting to Open Up

So far, 2018 has seen little to no activity in

the European and North American visa-policy space, although

American and British foreign policy continues to dominate

headlines. By contrast, dozens of new immigration and border

policies have been legislated by countries in Asia and the former

Soviet Union in recent months, as well as in Africa and the

Caribbean.

Following the general pro-tourism trend emerging in the

Middle East, governments in other regions are seeking to boost

visitor inflows as a means of stimulating economic growth,

strengthening diplomatic ties, and improving travel prospects for

their own citizens.

Discussing the Caribbean region, Dr. Suzette

Haughton, a Senior Lecturer in Geography at the University of the

West Indies, notes that countries such as Grenada, Haiti, and the

Dominican Republic are actively strengthening their passport power

through engagement with powerful Asian and Middle Eastern states �

and this engagement is visible in the migration space as well as

in the travel space.

�A major development to

watch in the upcoming quarter concerns the increasing mobility of

Chinese and Taiwanese business migrants into the Caribbean region,

coupled with the alignment of individual Caribbean countries�

national interest concerns with those of either China or Taiwan,�

Dr Haughton said.

Ukraine, too, has substantially relaxed its

immigration policies over the years, introducing visa exemptions,

visas-on-arrival, and, as of April 2018, e-Visas for almost every

nationality in the world. Much like the UAE, the country has

experienced a critical boost to trade and tourism since it opened

its borders to Chinese nationals in particular, reporting a 200%

increase in Chinese visitors since the policy came into effect in

2015. Ukraine has also been the beneficiary of two new visa-waiver

agreements (with Peru and Uruguay) this year, solidifying the

gains it made in 2017 when it gained access to the entire Schengen

Area.

China, which has historically been very

difficult to access, is gradually reciprocating the warm welcome

it has received on the global stage. On 1 May, the government

announced that citizens of 59 countries could travel to its

popular Hainan province visa-free for a month � an unprecedented

move for the traditionally closed-off nation.

Volek said, �Countries such as

China and the UAE that are rapidly ascending the Henley Passport

Index remind us that opening your borders to others results in

reciprocal benefits and improved passport strength for your own

citizens. The countries that perform well on the index are those

that are embracing new models of global citizenship and adapting

to, rather than shrinking away from, an increasingly globalized

world. The index is a useful yardstick for intergovernmental

policies and progress, and we expect to see further exciting

developments with each quarterly update.�

Investment Migration

Investment migration is a critical mechanism for

those with low-ranking passports or those in immigration-hostile

zones.

As Volek explains: �Citizenship-by-investment programs

allow financially independent individuals to make a substantial

economic contribution to a particular country, in exchange for

which they become a citizen of that country and receive a

passport. The most credible programs in the industry are all

linked to passports that consistently outperform on the Henley

Passport Index. Malta, for example, now boasts visa-free access to

182 destinations, while Antigua and Barbuda in the Caribbean

provides access to 149 destinations, including the entire Schengen

Area.�

�Crucially,� he adds, �the benefits do not only

flow one way. The industry is as popular and as successful as it

is because it offers equally real and tangible benefits to

countries with programs in place. Our most recent industry report,

produced in partnership with The Economist Group, shows that the

foreign direct investment generated by investment migration

programs results in fresh capital inflows to both the public and

the private sector, helping to stimulate socio-economic growth and

development. It is precisely the mutually beneficial nature of

investment migration that will ensure its continued growth and

sustainability in years to come.�

|

Headlines: |

|

See latest

HD Video

Interviews,

Podcasts

and other

news regarding:

Henley Passport Index,

Passports.

|