|

The outlook for international business travel is

generally optimistic, according to the Global Business Travel

Forecast 2018 published by American Express Global Business Travel

(GBT).

Demand for business travel started to rebound

last year, and is expected to grow over the next 12 months, with

some notable gains expected in Europe and Asia. China and India�s

high-powered economies once again lead the way. However, prices

will see only marginal gains, as suppliers rapidly increase

capacity to meet demand as they compete for market share.

Despite the recent economic progress made in

many global marketplaces, an element of caution remains in some

quarters. Geopolitical instability combined with moves by some

governments towards more protectionist economic policies has

generated an undercurrent of uncertainty in the business

community.

Global Highlights

Air: While strong demand is expected to drive

airfare increases across all regions, overcapacity on certain

routes, aggressive expansion by low-cost carriers (LCCs), and low

oil prices will keep them in check. Full-service carriers are

increasingly unbundling fares and adding premium economy seating

options to entice consumers to better compete with LCCs.

Hotel: Hotel performance is expected to improve

globally, with small to moderate rate increases driven by

strengthening regional economies, despite robust investment in new

hotel supply. Total costs, however, should increase even further

as additional ancillary fees and stricter cancellation policies

are applied by many hotels looking to bolster profitability.

Ground: After years of flat or negative growth,

rental car rates should finally see increases as companies improve

their fleet management while operating costs put pressure on

pricing. However, competition will remain fierce. In the absence

of significant rate increases, car rental companies are once again

turning to ancillary services and fees to drive greater

profitability.

Jo Sully, Vice President & General

Manager, American Express Global Business Travel, Australia & New

Zealand, said �Modest increases in fares across air travel and

hotel are expected across Asia-Pacific as a result of renewed

business confidence within the region, driven largely by the

influence of China and India. Despite positive economic

conditions, companies continue to seek cost savings in travel, and

we anticipate continued scrutiny in areas such as trip length,

moving bookings online, hotel consolidation, and advanced

bookings.�

APAC

Strong growing

economies across much of the Asia-Pacific region and a burgeoning

middle-class are causing demand for travel to surge. However,

China remains a key driver of this growth and a slowdown of its

economy could have a ripple effect throughout the region.

Airfares

will remain relatively stable compared to 2017, as political

stability and strong demand in China and India, is counterbalanced

by widespread overcapacity and flatter demand in Japan and

Australia.

Domestic carriers in China will also have to compete

with the world�s fast-developing high-speed rail network, which

accounts for more than two-thirds of the world�s capacity and is

expected to grow another 50% by 2020.

Hotel

rates in the region will generally increase as growing business

confidence and a thriving tourism sector drive up demand, although

this will vary considerably by country. South Korea is the only

nation expected to see rate decreases, largely as a result of

China�s tourism ban.

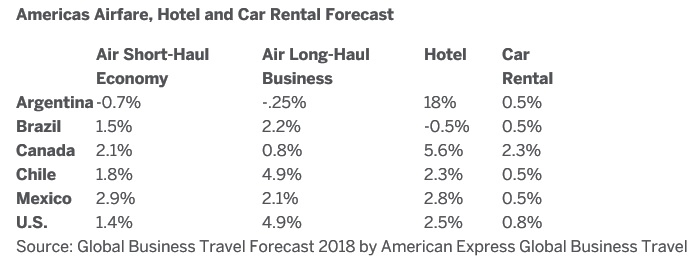

Americas

In North America, U.S. foreign policy will loom

large in 2018, as foreign trade agreements are renegotiated,

potentially impacting international demand for travel.

Already

facing weakening demand and overcapacity on some international

routes, U.S. carriers are re-prioritizing domestic operations,

with additional connections to secondary, smaller destinations.

The direct competition with LCCs will help keep fare increases

modest next year. In Latin America, airfares should see slight

increases thanks to regulatory changes and increasing demand along

international routes.

U.S. hoteliers will contend

with decreases in foreign travelers and overcapacity in many major

cities, with rates only expected to increase up to three percent

on average over last year. However, this will vary significantly

by location and some areas, like Silicon Valley, will continue to

see rates climb.

Canada will benefit from this uncertainty, with

demand - particularly from U.S. visitors - largely outpacing

supply in key locations such as Vancouver, Montreal and Toronto,

resulting in high single-digit rate increases.

Hotel rates in

Latin America will remain generally flat in 2018, although

Argentina and Peru will see significant increases due to promising

economic activity.

Ground transportation in North

America will still struggle in 2018, but can expect slight rate

increases for the first time in years. Despite fierce competition

amongst rental car suppliers, improved fleet controls and mounting

cost pressures will help push rates higher, especially amongst

smaller clients.

Ride-sharing services like Uber and Lyft will

continue to have limited impact on car rental demand, providing

complementary service better suited to short trips and urban

locations. However, their focus on convenience and mobile

technology are pushing suppliers to focus on travel experience

improvements.

Latin America can also expect slight ground rate

increases, due to economic growth and despite low-cost supplier

competition.

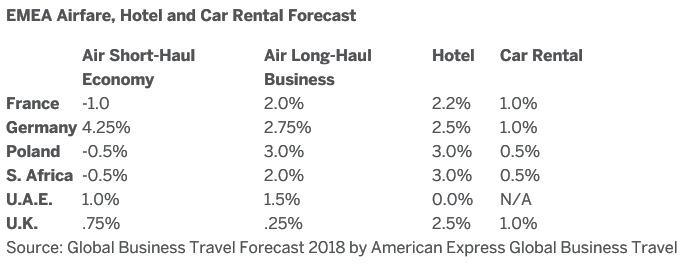

EMEA

In

Europe, the U.K.�s decision to withdraw from the European Union

(EU) � known colloquially as Brexit � could impact travel

throughout the region as carrier operations and passenger demand

potentially shift.

British carriers will see airfares remain flat,

while air and rail suppliers servicing the region will look to the state

of Brexit negotiations to determine how their operations could be

affected as border control and air traffic rights are redefined

ahead of the 2019 deadline.

In Europe notable

increases in hotel rates are expected, except for the U.K. and

Spain, with hotels across the region seeing growth in demand

driven by tourism, which has outpaced limited increases in new

supply.

Ground transportation has benefited from increased demand

as well with rental car demand expected to grow slightly. However,

aggressive competition between rental car suppliers, as well as

millennial shifts towards ridesharing and public transportation,

will keep prices relatively flat.

The full Global Business Travel Forecast 2018,

published by American Express Global Business Travel, can be

downloaded in .pdf format, after filling in a few details,

here.

|

Headlines: |

|

See latest

HD Video

Interviews,

Podcasts

and other

news regarding:

American Express,

Trends,

Outlook,

Forecast.

|