|

AccorHotels has

reached agreement with a wholly-owned subsidiary of

the Abu Dhabi Investment Authority (ADIA) to restructure a portfolio of 31 hotels (4,097 rooms) in Australia.

The

agreement involves a portfolio which was purchased by the ADIA

subsidiary in 2013 and operated by AccorHotels.

Under the

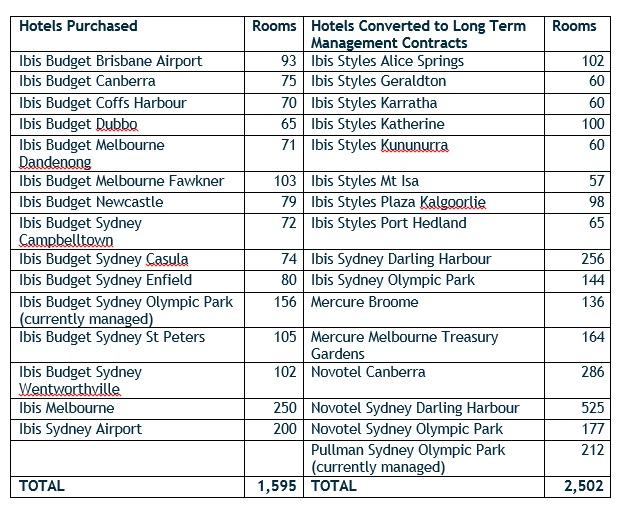

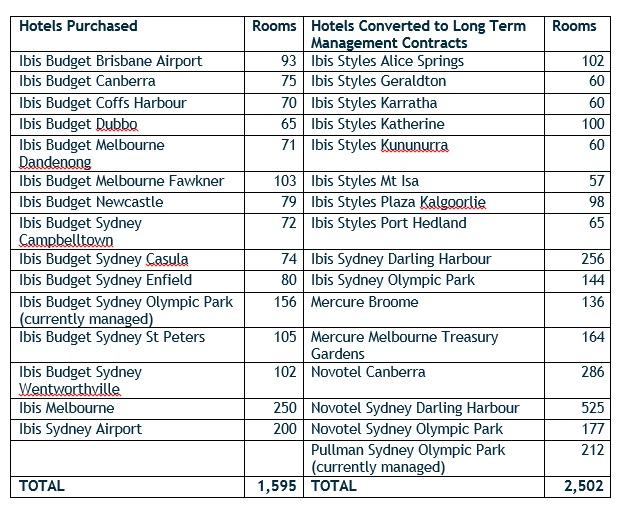

restructure of the portfolio of 31 hotels:

- AccorHotels will

convert 15 triple-net leases into 50 year management agreements

and extend the management term of one hotel also to 50 years

(total 16 hotels);

- AccorHotels (HotelInvest) will acquire

the real estate of the remaining 15 ibis and ibis Budget

branded properties for AUD$200 million (�137 million).

�This deal is in line with our stated strategy to optimise

cash flow generation, reduce earnings volatility and restructure

lease contracts into owned and managed hotels,� said John Ozinga,

COO of HotelInvest. �The acquisition of the economy hotels in key

locations is a signal of our continued focus on supporting the

Group�s growth strategy by holding a selective portfolio of

profitable hotel property assets.�

The

hotels are located in prime locations including Sydney�s Darling

Harbour, Sydney Olympic Park and in Canberra, Australia�s Capital

City.

The portfolio is also spread across city and regional

locations in New South Wales, Victoria, Northern Territory,

Western Australia and Queensland and encompasses the Pullman,

Novotel, Mercure, ibis, ibis Styles and ibis Budget brands.

The acquisition will be accretive to AccorHotels� EBIT in 2017

and will further strengthen its market leadership position in

Australia by securing tenure on key assets. Completion of the

acquisitions is subject to the usual conditions for this type of

transaction, as well as regulatory approvals.

See other recent

news regarding:

AccorHotels,

Abu Dhabi,

Australia.

|